REPORT 2019

Reflections from our Chief Financial Officer

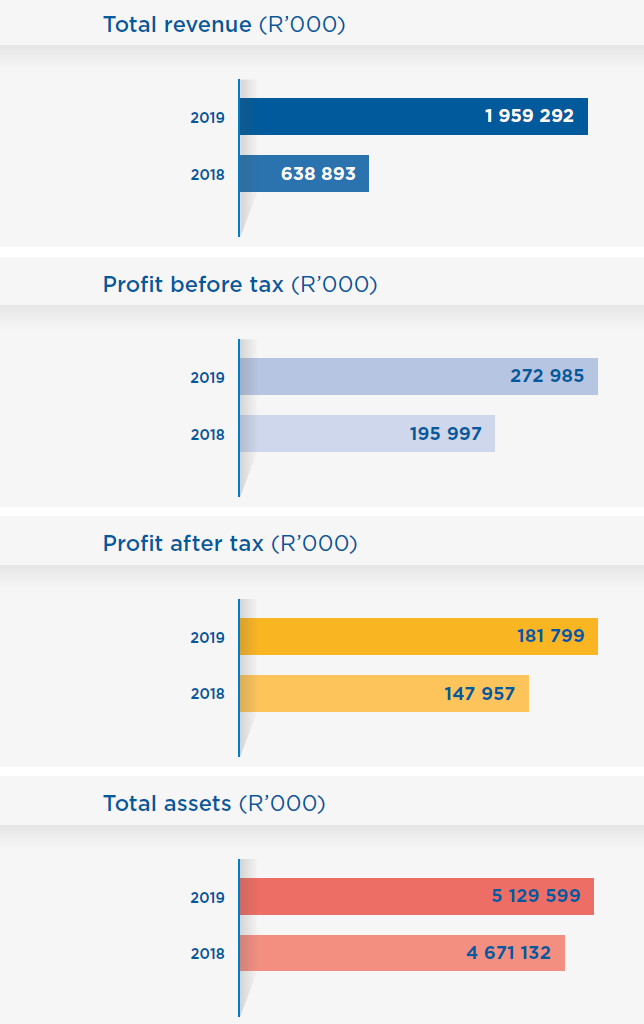

The AYO Group delivered a robust financial performance for the year ended 31 August 2019 despite a challenging operating and economic environment with revenue increasing by 207% to R1.9 billion, profit after tax increasing by 23% to R182 million.

Underpinned by organic growth, strategic acquisitions and operational excellence, our financial results are testament to our commitment to create value for our shareholders. The triple digit revenue growth, as well as associated growth in profitability and total assets, reflects the progress we have made in delivering our strategy.

Revenue increased as a result of organic and acquisitive growth, as mentioned above. Despite the exigent economic conditions facing the Group, revenues from our existing subsidiaries remained constant, with the exception of Puleng Technologies, which had a significant once-off contract in the previous reporting period.

While organic revenue growth for the Company itself and all our subsidiaries is the main focus of our daily operations, the executive team’s core attention has been centred around acquisitions. Diversification into revenue and profit-generating niche ICT segments continues to be a vital part of our growth strategy.

R338 million was invested in subsidiaries acquisition during the period which resulted in a sharp revenue upswing for the Group, even though these new subsidiaries’ results were only consolidated for parts of the reporting period. “Gearing for growth” requires an upfront investment in operational capacity. This financial year saw the implementation of a significant contract with a large multinational organisational client as the said contract came into effect in July 2018, just before the commencement of the reporting period. Fuelled by the consistent service delivery through the year and the positive commentary from the client along the way, the management team, has renewed confidence in AYO’s ability to secure more deals of similar magnitude. Thus, expenses were incurred to prepare us for concluding and implementing large contracts in 2020 and beyond. Yet, our concerted steadfastness to operational excellence led to the net decrease of operating expenses as percentage of revenue from 31.2% to 28.7%. This is a significant achievement for AYO in the light of implementation of a large contract with lower than historic margins during the reporting period.

The large multi-national organizational client mentioned above gave AYO six months’ notice purporting to terminate the contract with AYO. AYO disputes the client’s right to cancel the contract and has invoked the arbitrations provisions under the agreement. In the event that AYO is not successful with the arbitrations, we have commenced with plans to ensure that we minimise the financial impact of the potential loss of the contract.

With respect to the challenges we faced in 2019, we are cognizant that the impacting events are still ongoing and with that come risks which might affect our ability to secure contracts and deliver value. Media sentiment around the Group remains negative, which is damaging to our brand and reputation. A reputation building and marketing plan aimed at restoring confidence in AYO will be rolled out in 2020.

In spite of the severe risks from the reputational damage suffered and potential litigation, our outlook for 2020 is confident and optimistic. We expect a strong financial performance for the upcoming financial year aided by robust acquisition pipeline and organic growth within our subsidiaries. We continue to pursue acquisitions that present a strategic fit to our Group, as part of our growth strategy.

The 2020 financial year will also see a full set of performance results for Sizwe, SGT Solutions and GCCT being consolidated into the Group results, as compared to only eight months and six months respectively in 2019 financial year, due to IFRS reporting principles.

I would like to thank my colleagues on the Board for their guidance, leadership and support during this challenging year, as well as the Group’s finance team for their commitment, hard work and support.

Isaiah Tatenda Bundo

Chief Financial Officer