REPORT 2019

Investment committee report

Dear Stakeholder,

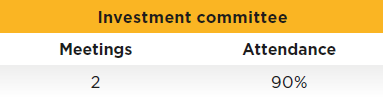

I am pleased to address you once again, this time in my role as the chair of the investment committee and share with you the committee’s activities for the 2019 reporting period. During the year, we met twice with each meeting enjoying full attendance of committee members as well as hosting the executive team by invitation. In terms of membership, we saw one resignation – that of Mr Malick Salie, who was replaced by Tatenda Bundo. We welcome Mr Bundo to the panel and are grateful for his valuable contributions already.

The main purpose of the investment committee is to consider acquisitions and disposal of assets in line with the Group’s strategy to ensure growth and development of the organisation. We review the investment strategy of the Group, set criteria and targets for investments, approve proposals for acquisitions and sales of companies, review due diligence processes for acquisitions and approve equity and other strategic investments.

2019 was a busy year for AYO in terms of acquisitions with the following agreements finalised during the period:

- Acquisition of 55% shareholding in Sizwe Africa IT – a company specialising primarily in the infrastructure segment, including fibre optic cabling, continuous energy supply and data centres;

- Acquisition of 40% stake in SGT Solutions – a turnkey solutions integrator servicing mobile network operators, large public and private organisational clients and SOEs;

- Acquisition of 24% ownership in Global Command and Control Technologies – a niche technology provider to the military, defence and security sector; and

- Acquisition of 43% equity interest in Puleng Technologies, thus increasing AYO’s total shareholding in Puleng to 100%.

We have also considered and approved the acquisition of a stake in Cortex Logic, an African Artificial Intelligence software company – a transaction which will come into effect in the 2020 financial year. Cortex Logic services clients in a range of industries from agriculture and mining to tourism and construction and is a stellar example of AYO’s delivery on strategic goals, namely expansion into new ICT segments where we didn’t have presence previously.

Another massive step towards the realisation of our strategic objectives and overall value creation was the formation of a Fintech Fund, in which AYO invested R100 million. The fund is designed to support startups and emerging South African ICT businesses. Through this fund we anticipate accelerating growth opportunities for innovative young companies, thus driving overall economic growth and development, while simultaneously realising robust returns for our shareholders and advancement towards our socio-economic development goals. With acquisition growth forming a major part of AYO’s growth strategy for 2020 and beyond, the committee will continue to identify investment opportunities in both established and emerging ICT businesses that will enable the Group to achieve significant market penetration and product portfolio diversification. We will look at opportunities for expansion in the SADC region to enhance the geographical footprint of our business.

Dr Wallace Mgoqi

Chairman of Investment Committe

31 January 2020