REPORT 2019

Our risk management

Risk management is an integral part of our value-based strategy, our governance and our day-to-day operations. We believe that each risk carries an associated opportunity and aim to not only deal with uncertainty in the business environment and minimise our downside exposure but also seek to capitalise on the upside potential to achieve our strategic objectives. Thus, our integrated and cohesive approach to risk management is inextricably linked to strategy formulation and execution.

Integrated Risk Management Model And Combined Assurance

AYO’s integrated risk management framework sets the foundation for our businesses to effectively manage environmental risks in a standardised and systematic manner.

The Board approves AYO’s risk profile, financial risk appetite and tolerance levels and ensures that risks are managed within these levels. To support the Board and ensure effective risk management oversight, each committee is responsible for monitoring relevant risks within the ambit of its scope.

The internal auditor performs an independent objective assurance function and consulting activity on the adequacy and effectiveness of the Group’s systems of governance, risk management and internal controls. The system of internal control is designed to ensure that significant risks are appropriately identified, managed and provide reasonable assurance that:

- Company assets and information are safeguarded;

- Operations are efficient and effective; and

- Applicable laws and regulations are complied with.

BDO Cape Inc., the external audit firm, provides an audit opinion in accordance with the Companies Act, the JSE Listing Requirements and King IV™. They assist the audit and risk committee in discharging their corporate governance and compliance responsibilities. They provide advice on financial reporting, tax and business issues and make recommendations to management to improve internal controls and business efficiencies to add further value to the Company.

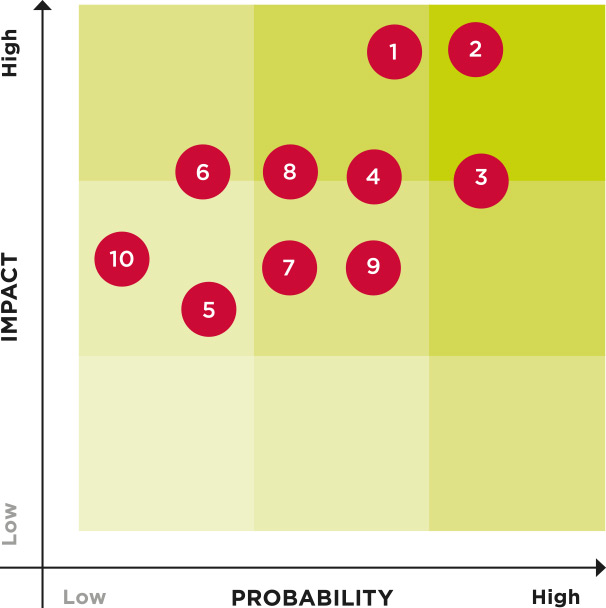

AYO’s risk management model is further applied to our “watch list”, which contain risk areas not specifically covered in the Group’s top risks. Our “watch list” is constantly evolving and together with the top risks list represents a comprehensive coverage of themes that could potentially impact on the Group’s performance.

The watch list themes include:

- South Africa’s and Africa’s political and economic developments;

- Significant changes in public sector ICT expenditure;

- New and changing laws and regulations affecting the ICT industry and the industry verticals we operate in;

- Changes in customers’ buying criteria;

- Disruptive new technologies launched in the world;

- Governance and integrity perception of our Group by regulators, media and shareholders;

- Reputation management for our subsidiaries;

- Time spent in legal and other non-core value-generating activities.